How to Open BPI Savings Account Para sa Pinoy Then I found out about BPI Save Up with free insurance. I have read good and bad reviews but in the end, I still decided to open up an account. It's sad that it isn't possible to open a BPI Save Up account online anymore. I even emailed BPI Direct but did not receive any response. I realized that I …

BPI Direct Account Opening Procedure phinvest

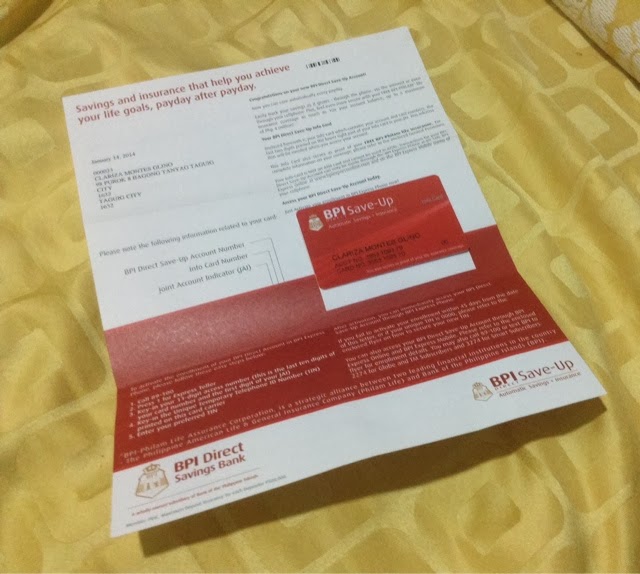

How to Open a BPI Save Up Account – Frugal Honey. Three years ago, I opened a Save-Up Automatic Savings + Insurance account at BPI Direct Savings Bank. I was mainly enticed by the free life insurance coverage from BPI-Philam Life Assurance that comes with it. Just recently, I closed the account for the following reasons: Downsizing. I have one too many BPI Direct accounts already. I’m fine […], If you have an existing ATM based BPI account enrolled in BPI Express Online banking facility, saving regulary would be easy with BPI Direct Save-Up.. This offering will let you decide how much you want to save on a regular basis. The amount you want to save will be deducted to your BPI ATM-based savings account and will be transferred to your BPI Direct Save-Up account..

Start the habit of saving with BPI Direct Save-Up Automatic Savings + Insurance Saving is tough, especially when the urge to splurge becomes overwhelming. Hold yourself back from overspending with the help of BPI Direct Save-Up! Savings that's easy to start … Save automatically with Save-Up! This product transfers a nominated amount from an ATM account to a Save Up Account. Open a Save-Up Automatic Savings account today! Visit a BPI or BPI Family Savings Bank branch near you. PRODUCT FEATURES: No initial deposit required. Convenient monitoring via enrollment in BPI’s 24/7 channels which include:

BPI Save-Up. With Save-up, you can automatically deduct or transfer your funds from your regular savings account to your save-up account on a monthly or bi-monthly basis. You don’t need to go to the bank to withrdraw then deposit to this account. You can customize the settings or automation and it will do it on its own moving forward. BPI Direct Savings account application is done via internet. Yes, you can apply for an account at the convenience of your own home or office as long as you have an internet connection. Also, you don't have to be in the Philippines to do this. You can still apply and just nominate someone to pick up the card for you like a family member or a friend.

BPI Save-Up. With Save-up, you can automatically deduct or transfer your funds from your regular savings account to your save-up account on a monthly or bi-monthly basis. You don’t need to go to the bank to withrdraw then deposit to this account. You can customize the settings or automation and it will do it on its own moving forward. From managing your company's funds to growing your wealth - easy with BPI Asset Management.

02/02/2019В В· In this video, I share to you guys my secret to a worry-free banking lifestyle with my favorite deposit account, the BPI Kaya Savings Account (formerly known as Easy Savings Account). The best 02/02/2019В В· In this video, I share to you guys my secret to a worry-free banking lifestyle with my favorite deposit account, the BPI Kaya Savings Account (formerly known as Easy Savings Account). The best

BPI ATM Requirements 2015 BPI Savings Account Opening Requirement 1. Submission of duly completed and executed account opening forms - the bank teller or bank personnel will give you this 02/02/2019В В· In this video, I share to you guys my secret to a worry-free banking lifestyle with my favorite deposit account, the BPI Kaya Savings Account (formerly known as Easy Savings Account). The best

Three years ago, I opened a Save-Up Automatic Savings + Insurance account at BPI Direct Savings Bank. I was mainly enticed by the free life insurance coverage from BPI-Philam Life Assurance that comes with it. Just recently, I closed the account for the following reasons: Downsizing. I have one too many BPI Direct accounts already. I’m fine […] BPI Save-up Automatic Savings Account. If you’re doing your personal money saving challenge, you might want to put up your Save-Up account. This way, you’ll able to save for your emergency funds or for future use. Let’s admit it, most people don’t want to do the extra effort to save money.

When I first learned about BPI Save Up more or less 10 years ago while I was still working at a BPO, I immediately opened one. I got to have automatic savings and free insurance? What’s not to like? Why not let my money do two things, instead of doing only one thing? Unfortunately, when I changed jobs my payroll bank account also changed. Chit Chat on BPI Save Up September 19, 2014 / Budgeting & Saving / 38 Comments. In my last post, I briefly talked about my plan of opening up a BPI Save Up account because of its life insurance aspect.

In this post, we’ll be talking how to enroll for BPI easy saver savings account, the BPI easy saver requirements, and later we will tackle some of the most commonly asked questions. BPI Easy Saver Features: Account opening for as low as PHP 200. NO maintaining balance. For a minimal fee, withdrawal transactions are made convenient. Take note that BPIExpressOnline only allows up to 20 BPI savings account and 20 BPI checking account to be enrolled in their system. I don’t know if anyone have plenty of savings and checking accounts. Enrolling additional accounts in BPIExpressOnline is very easy. I will teach you how but first you must learn how to register in BPIExpressOnline.

Whether you fancy automating your finances or you prefer doing it the traditional way, signing up for a BPI Express Online account will surely save you time and effort. It’s a win-win for both users and the BPI. Don’t have a BPI account yet? Find one that will suit your financial goals in our savings account listing page. 18/05/2016 · This is a step-by-step process on how to transfer funds from BPI Savings Account to BPI Save-up Account through BPI Express Online. BPI KAYA SAVINGS ACCOUNT REVIEW 2019 - Duration:

In my previous article How to Enroll a BPI Express Online Account in 3 easy steps, I described how I was able to enroll my BPI savings account into BPI Express Online. Since I also have another BPI checking account, I wanted to link my two accounts together so that I can monitor both of them online. BPI Kaya Savings Review. BPI Save-up: an account that helps you set aside money from your ATM account to your Save-Up account regularly (every month, twice a month, etc). BPI Jumpstart: an account that is specially designed for the youth, ages 10 to 17 years old.

How to Open a BPI Save Up Account – Frugal Honey

BPI Transfer to 3rd Party using QR Code for FREE (2019). BPI Direct Savings account application is done via internet. Yes, you can apply for an account at the convenience of your own home or office as long as you have an internet connection. Also, you don't have to be in the Philippines to do this. You can still apply and just nominate someone to pick up the card for you like a family member or a friend., Chit Chat on BPI Save Up September 19, 2014 / Budgeting & Saving / 38 Comments. In my last post, I briefly talked about my plan of opening up a BPI Save Up account because of its life insurance aspect..

A Complete guide on how to open savings account in BPI

Meowy-Go-Lucky How to Open a BPI Save Up Account with. BPI Direct Save-Up Account Features Automatic Savings . One of BPI Direct Save-Up’s main selling points is the automatic savings feature. They figured that if you remove yourself from the savings process, you’ll be able to earn more. https://en.wikipedia.org/wiki/Dave_(rapper) BPI Save-Up. With Save-up, you can automatically deduct or transfer your funds from your regular savings account to your save-up account on a monthly or bi-monthly basis. You don’t need to go to the bank to withrdraw then deposit to this account. You can customize the settings or automation and it will do it on its own moving forward..

When I first learned about BPI Save Up more or less 10 years ago while I was still working at a BPO, I immediately opened one. I got to have automatic savings and free insurance? What’s not to like? Why not let my money do two things, instead of doing only one thing? Unfortunately, when I changed jobs my payroll bank account also changed. BPI Save-Up. With Save-up, you can automatically deduct or transfer your funds from your regular savings account to your save-up account on a monthly or bi-monthly basis. You don’t need to go to the bank to withrdraw then deposit to this account. You can customize the settings or automation and it will do it on its own moving forward.

20/06/2013 · I just went to BPI a few days ago to inquire and also ask advice on what is the best peso account that is safe and will yield the highest interest rate. I told the bank personnel that I won’t be using a certain amount of money for 1 year. The bank personnel explained to me about the maxi-saver account and the BPI advance savings. 11.BPI Save-Up Automatic Savings + Insurance - P1,000 12.BPI Save-Up High Automatic Savings - P1,000 Dollar Savings Account 1. Express Dollar Savings - $500 2. Dollar Savings with Passbook - $500 BPI Family Savings Bank The ff: are the various maintaining balance requirement of BPI Family Savings Bank's Savings Account Deposit Products. Peso

How to Open a BPI Save Up Account February 25, 2016 / Budgeting & Saving / 29 Comments. One of the easiest way to save money, be it for your emergency funds, future travel, dream bag etc, is to automate it. Then I found out about BPI Save Up with free insurance. I have read good and bad reviews but in the end, I still decided to open up an account. It's sad that it isn't possible to open a BPI Save Up account online anymore. I even emailed BPI Direct but did not receive any response. I realized that I …

The BPI Jumpstart Savings accountholders can reload their cellphones at any BPI Express Teller ATMs, via phone at the BPI Express Phone 89-100 or the BPI Express Mobile. On the other hand, they can also choose to reload their cellphones through the internet via the BPI Express Online. How to Apply for a BPI Jumpstart Savings Account? Did you get B Save Up account? If yes, you must have got your account number. This is a basic requirement which BPI isn’t going to miss. If you have applied and yet to get confirmation, please wait. They will inform you whether your account application is accepted or rejected.

BPI Kaya Savings Review. Saving money in the bank doesn’t always require a lot of money and it also doesn’t need a lot of requirements. With BPI Kaya Savings, you can open your account with just ₱200 and start saving your extra funds for your future. When you have your own savings account, you will be more motivated to save up than when you just keep your money in your wallet or in a 16/03/2016 · What kind of BPI account is best for someone who wants to start saving? What kind of BPI account is best for someone who wants to start saving? I already read some of the accounts posted in the BPI site but will be needing input from someone who have BPI accounts. BPI Family has a savings account with a minimum of 1k maintaining balance.

BPI Save-up Automatic Savings Account. If you’re doing your personal money saving challenge, you might want to put up your Save-Up account. This way, you’ll able to save for your emergency funds or for future use. Let’s admit it, most people don’t want to do the extra effort to save money. Planning to open a new (BPI) Savings Account? You may choose from either Kaya Savings, Express Teller ATM or Passbook Savings. Check the requirements on opening a new bank account from the Bank of the Philippine Islands on this post as well as find the answer to some frequently asked questions regarding BPI bank accounts and possible fees.

Take note that BPIExpressOnline only allows up to 20 BPI savings account and 20 BPI checking account to be enrolled in their system. I don’t know if anyone have plenty of savings and checking accounts. Enrolling additional accounts in BPIExpressOnline is very easy. I will teach you how but first you must learn how to register in BPIExpressOnline. 02/02/2019 · In this video, I share to you guys my secret to a worry-free banking lifestyle with my favorite deposit account, the BPI Kaya Savings Account (formerly known as Easy Savings Account). The best

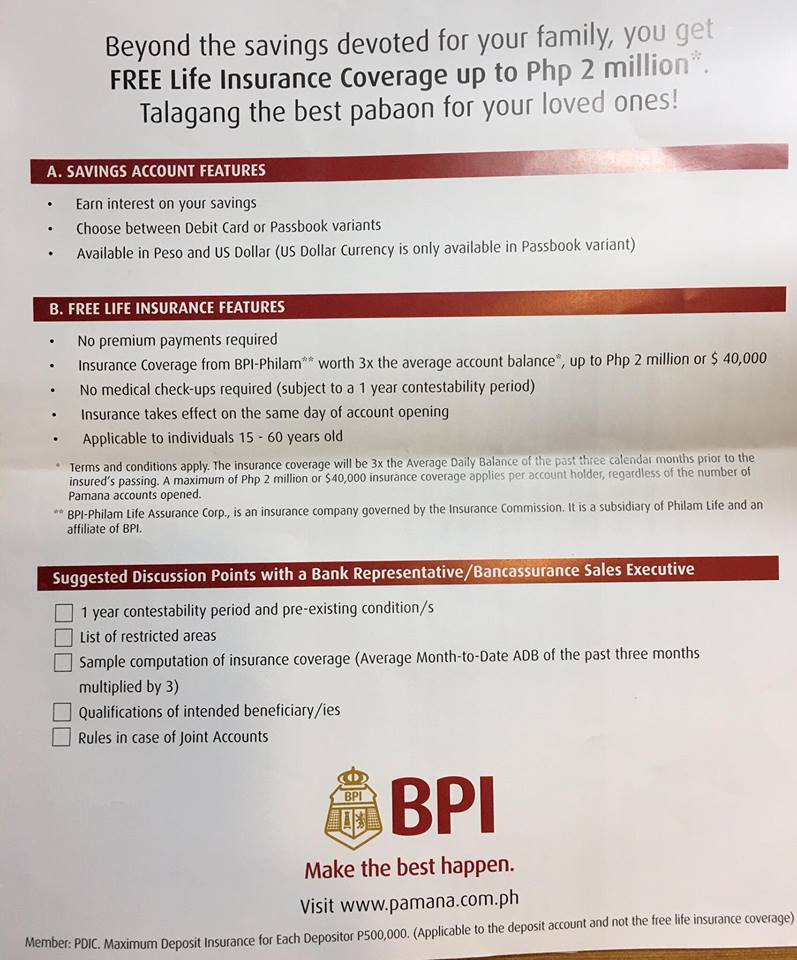

This post refers to the first type: Save Up account WITH INSURANCE. Features of BPI Save Up + Insurance. BPI Save Up provides FREE insurance coverage for basic life and accidental death of up to 5 times your month-to-date average daily balance (MTD-ADB) for the past three months of up to a maximum of Php 2 million. How To View Your Save Up Account Transactions Online Pinoy Work Bpi Express Online Banking Quick Review And How To Guide Bpi Balance Inquiry And Transaction History Olanap Com Where To Find Jai In New Bpi Atm Card Kayacard Co How Do I Fund My Col Account Over The Counter Via Merchant Payment

Two years ago I opened my BPI Direct Save-Up plus Insurance account to kick-start my emergency fund. I have featured it in a first impression review as soon as I received my Info Card in February 2014 and a blog update in October 2014.Just like the others I got really excited with the word “insurance” alongside this particular savings account from BPI. BPI Save-Up. With Save-up, you can automatically deduct or transfer your funds from your regular savings account to your save-up account on a monthly or bi-monthly basis. You don’t need to go to the bank to withrdraw then deposit to this account. You can customize the settings or automation and it will do it on its own moving forward.

How to Open a BPI Save Up Account February 25, 2016 / Budgeting & Saving / 29 Comments. One of the easiest way to save money, be it for your emergency funds, future travel, dream bag etc, is to automate it. Accidental Dismemberment: in accordance with the Schedule of Dismemberment Benefits, up to PhP 2 million. 4. As for the cases of real emergencies, you can simply transfer funds from your BPI Direct Save-Up to your nominated source account via Express Mobile, Express Banking or Express Phone.

BPI Kaya Savings Review. Saving money in the bank doesn’t always require a lot of money and it also doesn’t need a lot of requirements. With BPI Kaya Savings, you can open your account with just ₱200 and start saving your extra funds for your future. When you have your own savings account, you will be more motivated to save up than when you just keep your money in your wallet or in a This post refers to the first type: Save Up account WITH INSURANCE. Features of BPI Save Up + Insurance. BPI Save Up provides FREE insurance coverage for basic life and accidental death of up to 5 times your month-to-date average daily balance (MTD-ADB) for the past three months of up to a maximum of Php 2 million.

BPI Savings Account Requirements Bigwas

Features of BPI Save Up + Insurance Katie Scarlett Needs. BPI Save-Up. With Save-up, you can automatically deduct or transfer your funds from your regular savings account to your save-up account on a monthly or bi-monthly basis. You don’t need to go to the bank to withrdraw then deposit to this account. You can customize the settings or automation and it will do it on its own moving forward., Access our investment funds through any of the BPI Branches nationwide or, via the Internet through BPI ExpressOnline. As a BPI Investment Fund participant, you are not limited to your branch of account for your investment fund transactions. You can subscribe to or redeem from our investment funds in any branch, or even through BPI ExpressOnline..

How to Open a BPI Jumpstart Savings Account? Moneymax

BPI Express Online Banking Quick Review And How-To Guide. BPI Kaya Savings Review. BPI Save-up: an account that helps you set aside money from your ATM account to your Save-Up account regularly (every month, twice a month, etc). BPI Jumpstart: an account that is specially designed for the youth, ages 10 to 17 years old., Then I found out about BPI Save Up with free insurance. I have read good and bad reviews but in the end, I still decided to open up an account. It's sad that it isn't possible to open a BPI Save Up account online anymore. I even emailed BPI Direct but did not receive any response. I realized that I ….

Accidental Dismemberment: in accordance with the Schedule of Dismemberment Benefits, up to PhP 2 million. 4. As for the cases of real emergencies, you can simply transfer funds from your BPI Direct Save-Up to your nominated source account via Express Mobile, Express Banking or Express Phone. 4 Easy steps to open BPI easy saver savings account. 1. Go to the nearest BPI branch in your area. Tell the banker that you’re going to open a BPI easy saver account. 2. Fill up the application form and submit all necessary requirements advised by the bank teller. Make sure to double check all the information. 3.

BPI Direct Savings account application is done via internet. Yes, you can apply for an account at the convenience of your own home or office as long as you have an internet connection. Also, you don't have to be in the Philippines to do this. You can still apply and just nominate someone to pick up the card for you like a family member or a friend. Access our investment funds through any of the BPI Branches nationwide or, via the Internet through BPI ExpressOnline. As a BPI Investment Fund participant, you are not limited to your branch of account for your investment fund transactions. You can subscribe to or redeem from our investment funds in any branch, or even through BPI ExpressOnline.

4 Easy steps to open BPI easy saver savings account. 1. Go to the nearest BPI branch in your area. Tell the banker that you’re going to open a BPI easy saver account. 2. Fill up the application form and submit all necessary requirements advised by the bank teller. Make sure to double check all the information. 3. BPI Kaya Savings Review. BPI Save-up: an account that helps you set aside money from your ATM account to your Save-Up account regularly (every month, twice a month, etc). BPI Jumpstart: an account that is specially designed for the youth, ages 10 to 17 years old.

Save automatically with Save-Up! This product transfers a nominated amount from an ATM account to a Save Up Account. Open a Save-Up Automatic Savings account today! Visit a BPI or BPI Family Savings Bank branch near you. PRODUCT FEATURES: No initial deposit required. Convenient monitoring via enrollment in BPI’s 24/7 channels which include: From managing your company's funds to growing your wealth - easy with BPI Asset Management.

Whether you fancy automating your finances or you prefer doing it the traditional way, signing up for a BPI Express Online account will surely save you time and effort. It’s a win-win for both users and the BPI. Don’t have a BPI account yet? Find one that will suit your financial goals in our savings account listing page. Planning to open a new (BPI) Savings Account? You may choose from either Kaya Savings, Express Teller ATM or Passbook Savings. Check the requirements on opening a new bank account from the Bank of the Philippine Islands on this post as well as find the answer to some frequently asked questions regarding BPI bank accounts and possible fees.

BPI Direct Save-Up Account Features Automatic Savings . One of BPI Direct Save-Up’s main selling points is the automatic savings feature. They figured that if you remove yourself from the savings process, you’ll be able to earn more. The BPI Jumpstart Savings accountholders can reload their cellphones at any BPI Express Teller ATMs, via phone at the BPI Express Phone 89-100 or the BPI Express Mobile. On the other hand, they can also choose to reload their cellphones through the internet via the BPI Express Online. How to Apply for a BPI Jumpstart Savings Account?

The BPI Jumpstart Savings accountholders can reload their cellphones at any BPI Express Teller ATMs, via phone at the BPI Express Phone 89-100 or the BPI Express Mobile. On the other hand, they can also choose to reload their cellphones through the internet via the BPI Express Online. How to Apply for a BPI Jumpstart Savings Account? 20/06/2013 · I just went to BPI a few days ago to inquire and also ask advice on what is the best peso account that is safe and will yield the highest interest rate. I told the bank personnel that I won’t be using a certain amount of money for 1 year. The bank personnel explained to me about the maxi-saver account and the BPI advance savings.

Start the habit of saving with BPI Direct Save-Up Automatic Savings + Insurance Saving is tough, especially when the urge to splurge becomes overwhelming. Hold yourself back from overspending with the help of BPI Direct Save-Up! Savings that's easy to start … 11.BPI Save-Up Automatic Savings + Insurance - P1,000 12.BPI Save-Up High Automatic Savings - P1,000 Dollar Savings Account 1. Express Dollar Savings - $500 2. Dollar Savings with Passbook - $500 BPI Family Savings Bank The ff: are the various maintaining balance requirement of BPI Family Savings Bank's Savings Account Deposit Products. Peso

Step 4: Save or Share the newly created BPI QR Code. You can choose to save the QR code to your mobile device for later use. This was the method that we chose when we generated the QR code for this guide and have it imported earlier when doing the fund transfer. Another option here is to share it right away (see image below). How To View Your Save Up Account Transactions Online Pinoy Work Bpi Express Online Banking Quick Review And How To Guide Bpi Balance Inquiry And Transaction History Olanap Com Where To Find Jai In New Bpi Atm Card Kayacard Co How Do I Fund My Col Account Over The Counter Via Merchant Payment

18/05/2016В В· This is a step-by-step process on how to transfer funds from BPI Savings Account to BPI Save-up Account through BPI Express Online. BPI KAYA SAVINGS ACCOUNT REVIEW 2019 - Duration: The BPI Jumpstart Savings accountholders can reload their cellphones at any BPI Express Teller ATMs, via phone at the BPI Express Phone 89-100 or the BPI Express Mobile. On the other hand, they can also choose to reload their cellphones through the internet via the BPI Express Online. How to Apply for a BPI Jumpstart Savings Account?

How to Open BPI Kaya Savings No Maintaining Balance

How to open BPI Easy saver savings account [Steps and. BPI Direct Save-Up Account Features Automatic Savings . One of BPI Direct Save-Up’s main selling points is the automatic savings feature. They figured that if you remove yourself from the savings process, you’ll be able to earn more., 16/03/2016 · What kind of BPI account is best for someone who wants to start saving? What kind of BPI account is best for someone who wants to start saving? I already read some of the accounts posted in the BPI site but will be needing input from someone who have BPI accounts. BPI Family has a savings account with a minimum of 1k maintaining balance..

BPI Express Online Banking Quick Review And How-To Guide

3 Easy Steps on How to Open a BPI Savings Account. Start the habit of saving with BPI Direct Save-Up Automatic Savings + Insurance Saving is tough, especially when the urge to splurge becomes overwhelming. Hold yourself back from overspending with the help of BPI Direct Save-Up! Savings that's easy to start … https://en.m.wikipedia.org/wiki/Fortnite A Complete guide on how to open savings account in BPI. Last updated on February 11, 2018 by Billy. Opening savings account in BPI tutorial is one of the most searched articles on this blog. In fact, it’s in #1 most popular post on this blog right now. Save-up Automatic Savings..

In my previous article How to Enroll a BPI Express Online Account in 3 easy steps, I described how I was able to enroll my BPI savings account into BPI Express Online. Since I also have another BPI checking account, I wanted to link my two accounts together so that I can monitor both of them online. Then I found out about BPI Save Up with free insurance. I have read good and bad reviews but in the end, I still decided to open up an account. It's sad that it isn't possible to open a BPI Save Up account online anymore. I even emailed BPI Direct but did not receive any response. I realized that I …

BPI ATM Requirements 2015 BPI Savings Account Opening Requirement 1. Submission of duly completed and executed account opening forms - the bank teller or bank personnel will give you this A Complete guide on how to open savings account in BPI. Last updated on February 11, 2018 by Billy. Opening savings account in BPI tutorial is one of the most searched articles on this blog. In fact, it’s in #1 most popular post on this blog right now. Save-up Automatic Savings.

How To View Your Save Up Account Transactions Online Pinoy Work Bpi Express Online Banking Quick Review And How To Guide Bpi Balance Inquiry And Transaction History Olanap Com Where To Find Jai In New Bpi Atm Card Kayacard Co How Do I Fund My Col Account Over The Counter Via Merchant Payment BPI Direct Save-Up Account Features Automatic Savings . One of BPI Direct Save-Up’s main selling points is the automatic savings feature. They figured that if you remove yourself from the savings process, you’ll be able to earn more.

In this post, we’ll be talking how to enroll for BPI easy saver savings account, the BPI easy saver requirements, and later we will tackle some of the most commonly asked questions. BPI Easy Saver Features: Account opening for as low as PHP 200. NO maintaining balance. For a minimal fee, withdrawal transactions are made convenient. Whether you fancy automating your finances or you prefer doing it the traditional way, signing up for a BPI Express Online account will surely save you time and effort. It’s a win-win for both users and the BPI. Don’t have a BPI account yet? Find one that will suit your financial goals in our savings account listing page.

How To View Your Save Up Account Transactions Online Pinoy Work Bpi Express Online Banking Quick Review And How To Guide Bpi Balance Inquiry And Transaction History Olanap Com Where To Find Jai In New Bpi Atm Card Kayacard Co How Do I Fund My Col Account Over The Counter Via Merchant Payment 20/06/2013 · I just went to BPI a few days ago to inquire and also ask advice on what is the best peso account that is safe and will yield the highest interest rate. I told the bank personnel that I won’t be using a certain amount of money for 1 year. The bank personnel explained to me about the maxi-saver account and the BPI advance savings.

Login pages for BPI Certified Professionals, BPI Test Centers, BPI Proctors, BPI GoldStar Contractors, and individuals looking for continuing education units. BPI Accounts Building Performance Institute, Inc. This post will guide you on how you can open a savings account in BPI (Bank of the Philippines), the oldest and one of the biggest bank here in the Philippines. The Story Last year, I fulfilled another one of my “life list”. It is to open a bank account. This is technically my first...Continue reading now

Access our investment funds through any of the BPI Branches nationwide or, via the Internet through BPI ExpressOnline. As a BPI Investment Fund participant, you are not limited to your branch of account for your investment fund transactions. You can subscribe to or redeem from our investment funds in any branch, or even through BPI ExpressOnline. BPI Save-up Automatic Savings Account. If you’re doing your personal money saving challenge, you might want to put up your Save-Up account. This way, you’ll able to save for your emergency funds or for future use. Let’s admit it, most people don’t want to do the extra effort to save money.

4 Easy steps to open BPI easy saver savings account. 1. Go to the nearest BPI branch in your area. Tell the banker that you’re going to open a BPI easy saver account. 2. Fill up the application form and submit all necessary requirements advised by the bank teller. Make sure to double check all the information. 3. BPI Direct Account Opening Procedure. AC and MPI hit again as "onerous provision" contract review scope widens to include LRT 1 and beep card concession (the Phinvest Godfather's blessing is important to me), and he gave it a thumbs-up. So let's see how it goes. Merkado Barkada for Tuesday, January 28. The PSE closed down 21 points

Then I found out about BPI Save Up with free insurance. I have read good and bad reviews but in the end, I still decided to open up an account. It's sad that it isn't possible to open a BPI Save Up account online anymore. I even emailed BPI Direct but did not receive any response. I realized that I … 20/06/2013 · I just went to BPI a few days ago to inquire and also ask advice on what is the best peso account that is safe and will yield the highest interest rate. I told the bank personnel that I won’t be using a certain amount of money for 1 year. The bank personnel explained to me about the maxi-saver account and the BPI advance savings.

A Complete guide on how to open savings account in BPI. Last updated on February 11, 2018 by Billy. Opening savings account in BPI tutorial is one of the most searched articles on this blog. In fact, it’s in #1 most popular post on this blog right now. Save-up Automatic Savings. When I first learned about BPI Save Up more or less 10 years ago while I was still working at a BPO, I immediately opened one. I got to have automatic savings and free insurance? What’s not to like? Why not let my money do two things, instead of doing only one thing? Unfortunately, when I changed jobs my payroll bank account also changed.

BPI Kaya Savings Review. Saving money in the bank doesn’t always require a lot of money and it also doesn’t need a lot of requirements. With BPI Kaya Savings, you can open your account with just ₱200 and start saving your extra funds for your future. When you have your own savings account, you will be more motivated to save up than when you just keep your money in your wallet or in a How to Open a BPI Save Up Account February 25, 2016 / Budgeting & Saving / 29 Comments. One of the easiest way to save money, be it for your emergency funds, future travel, dream bag etc, is to automate it.